One of the main benefits to having a enterprise a line of credit score is that it’s revolving. That means you can entry the credit line when you need it, pay down the balance, and use the line once more as funds replenish. There are some ways you must use business lines of credit. Here are some in style reasons why different small enterprise house owners use credit score lines. With the resulting scores, we created our rankings and lender evaluations.

Some purposes will lead to a pending status, which requires further evaluation before last decision is rendered. Pay off an existing mortgage on a business or business funding property, together with potential cash-out opportunities. Buy business actual estate for your corporation, or as an actual estate investor.

How Does Curiosity Work On A Business Line Of Credit?

Depending on your specific business needs, a small business line of credit score could possibly be the simple resolution you need to meet your targets for growth — at a pace that is best for you. Forbes Advisor adheres to strict editorial integrity requirements. To the best of our data, all content is accurate as of the date posted, though presents contained herein could now not be available. The opinions expressed are the author’s alone and haven't been supplied, approved, or in any other case endorsed by our partners. While a enterprise line of credit works best for certain kinds of expenses, different forms of financing may work higher in some situations. Flights should be redeemed through the Wells Fargo Business Rewards web site or service heart.

But you additionally want to think about how quickly you presumably can pay off your line of credit score. The Commercial Letter of Credit fulfills payment per a contract agreement, sometimes used for international or home commerce. PayPal Smart Connect is a line of credit score that you need to use to make purchases through PayPal. PayPal Smart Connect can be used wherever that PayPal is accepted. However, the Late Fee won’t be more than the minimum fee that was due. What liability do I have for unauthorized costs made on my PayPal Business Cashback Mastercard?

Credit Cards

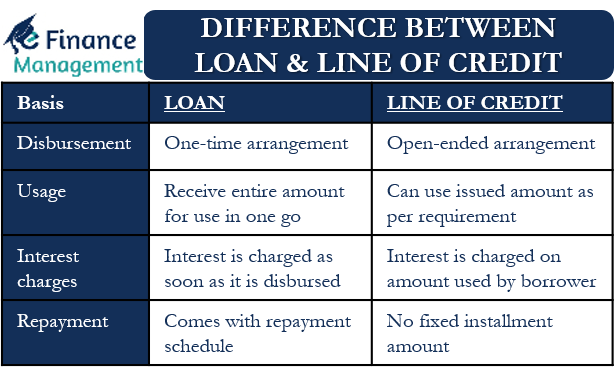

Business strains of credit operate like bank cards, but with a different structure that’s higher suited to small business homeowners. They’re additionally higher for tax purposes—you can write off curiosity on a credit line, however not for a private credit card. A enterprise line of credit is versatile, revolving capital that provides you entry to money.

Break down sudden or sizeable bills into extra manageable month-to-month funds, which may be game-changing for businesses of all sizes. There are multiple advantages of getting line of credit for enterprise, from gaining entry to short-term funding to more flexibility , in addition to extra business adaptability. If you are utilizing the wrong credit score or debit card, it might be costing you serious money. Our skilled loves this top choose, which features a 0% intro APR till 2024, an insane money back rate of as much as 5%, and all one way or the other for no annual fee. You may even see credit strains with a variable rate of interest, which suggests your interest rate can fluctuate based mostly on an index.

What's A Enterprise Line Of Credit?

Lines shall be evidenced by Chase’s standard documentation. Wells Fargo provides two unsecured traces of credit score, Wells Fargo BusinessLine® and Wells Fargo Small Business Advantage®. Both of those get you access to the Wells Fargo Business Line Rewards Program. A enterprise line of credit score is a possible option for a small or start-up enterprise to get the capital wanted to manage money move, fund day-to-day operations and reap the advantages of new alternatives.

Square offers advice on tips on how to prepare your small business to use. Find out what documents you need, credit score rating, and extra. The course of to acquire a secured line of credit score may take longer than the method for an unsecured line, because your assets could have to be verified and appraised as a source of reimbursement. Whether or not your line of credit score is secured or unsecured additionally might affect the amount of cash that you have access to and the rate of interest that you're charged. Second lien loans and contours are solely obtainable behind a Wells Fargo Bank first mortgage for established Wells Fargo enterprise checking or savings account customers.

Understanding Business Traces Of Credit

With a secured line of credit, the borrower puts up collateral as a safety deposit on the line of credit. Putting up property as a form of collateral is widespread, however this could additionally be different belongings owned by the enterprise, such as equipment or inventory. View and monitor your business credit score free of charge, powered by Dun & Bradstreet. At Business.org, our research is meant to supply common product and repair recommendations.

If your mortgage does not close within ninety days of your utility date, your price lock will expire and you may be topic to the present price. You should access funds from the Equipment Express® mortgage account inside 60 days of account opening. Use the equity in your industrial real estate to finance enterprise growth, equipment upgrades, and property enhancements.

She’s written several business books and has been published on websites including Forbes, AllBusiness, and SoFi. She writes about business and personal credit score, financial methods, loans, and bank cards. Commercial Real Estate products are subject to product availability and subject to change.

Instead of paying interest on the complete credit line, debtors owe curiosity solely on the funds they use. If you’ve found a lender that’s prepared to supply the money you need at acceptable phrases, think about the lender’s help choices earlier than signing the mortgage settlement. Customer help can make a huge distinction down the line if you encounter issues with repayment. Research the lender’s customer service sources and skim evaluations to ensure it’s an excellent match. OnDeck was founded in 2006 and has since been a number one provider within the enterprise lending house, offering both term loans and contours of credit score.

The way it works is that a financial institution or online lender might approve your established enterprise for a certain dollar amount, or restrict. Then when you withdraw funds, you subtract that number from the whole credit score restrict to find out your remaining obtainable credit score. The Business Elite Signature Card is a credit card for established businesses with annual gross sales over $1 million. It offers more buying energy, enhanced advantages and added safety to control employee spending. You can also choose to earn wealthy rewards points or money again. You can access data and the bank card applicationhere.

PNC Bank presents a secured enterprise equity line of credit that gives you seven years of revolving credit score during which you’re solely required to make funds on the curiosity you’re charged. After that, you’ll have 10 years to repay the funds that you simply borrowed. No annual renewal is required to maintain your credit score line open for the total seven-year interval.

No comments:

Post a Comment